Decoding Bank Value: How a Balanced Scorecard Can Boost Your Financial Health

"Discover how the Banking Risk Balanced Scorecard (BRBS) isn't just for banks; it's a strategic tool that can enhance value and drive success in today's complex financial landscape."

In the fast-paced world of finance, staying ahead requires more than just smart investments; it demands a keen understanding and management of risks. For years, the banking sector has grappled with various types of risk, making it essential to have tools that provide a comprehensive view of performance and potential pitfalls. The Banking Risk Balanced Scorecard (BRBS) emerges as a strategic solution.

This article delves into the concept of BRBS, particularly its application in the banking sector. We'll explore how this framework helps measure the effectiveness of risk management, aligning it with both shareholder value and competitive advantages. By understanding and implementing BRBS, banks can not only navigate the complexities of modern finance but also unlock new levels of success.

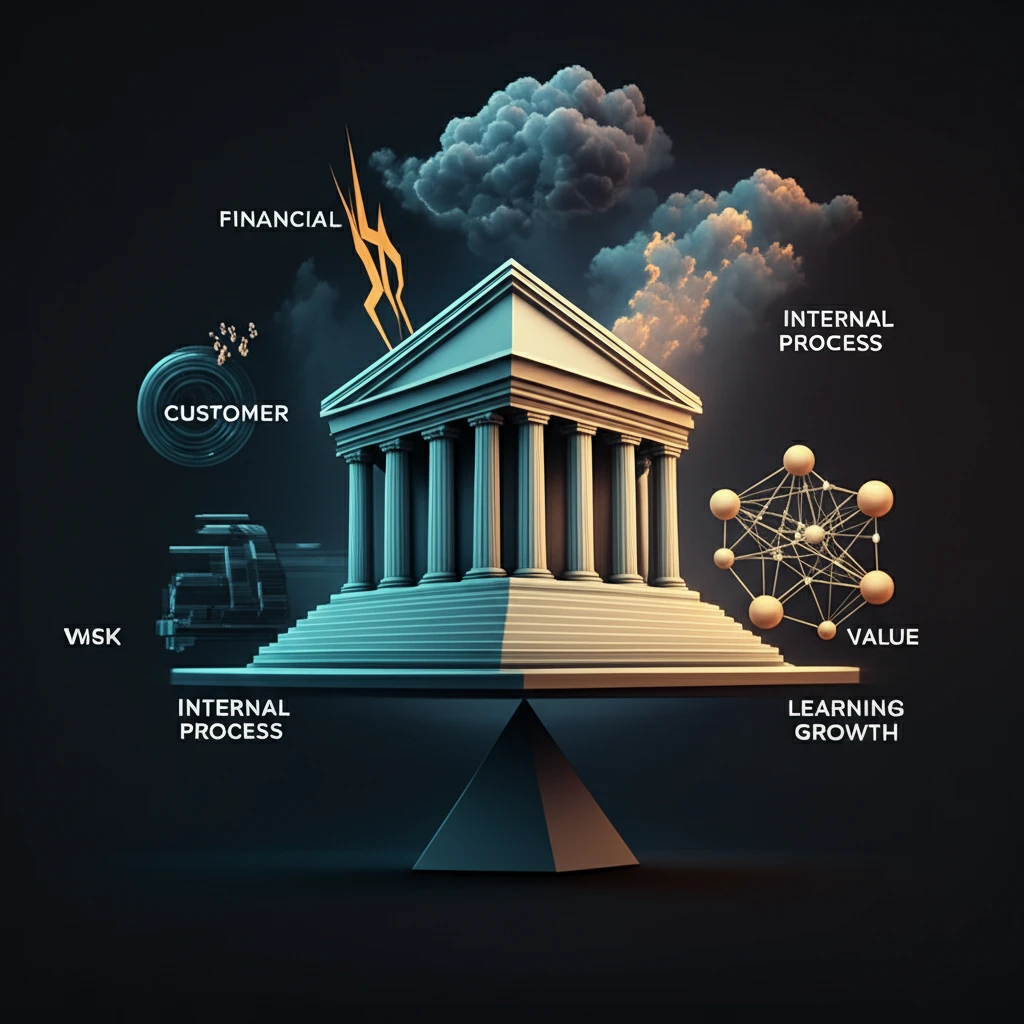

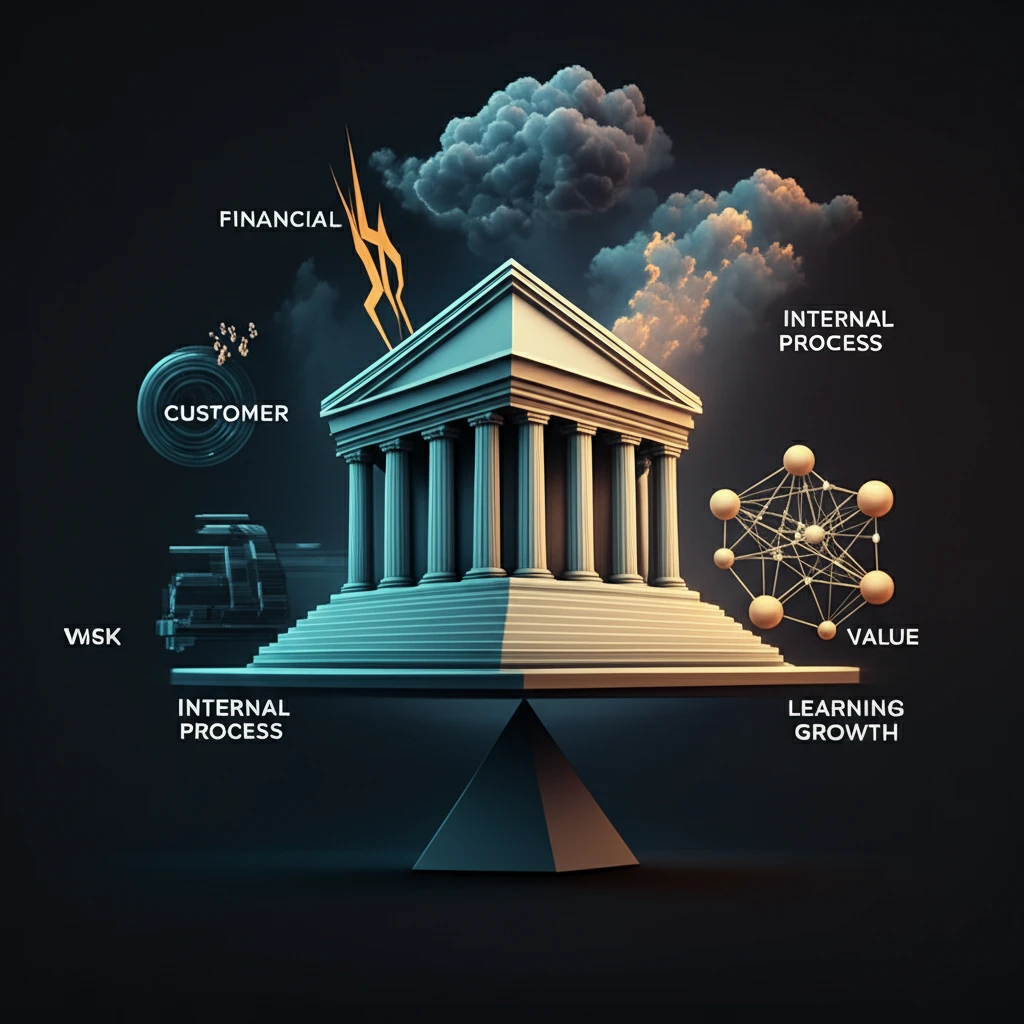

BRBS isn't just another metric; it's a holistic approach that considers various aspects of a bank's operations. It goes beyond traditional financial measures, incorporating elements like customer satisfaction, internal processes, and learning and growth. The goal is to create a balanced view that supports sustainable value creation and long-term prosperity.

Unveiling the Banking Risk Balanced Scorecard (BRBS): A Comprehensive Overview

The BRBS is a strategic performance management tool that goes beyond traditional financial metrics. It provides a comprehensive view by considering different perspectives, enabling financial institutions to make well-informed decisions. This approach helps banks align their risk management strategies with their overall objectives.

- Financial Perspective: Focuses on financial performance and stability, including profitability, return on assets, and capital adequacy.

- Customer Perspective: Examines customer satisfaction, retention, and acquisition to ensure a strong customer base.

- Internal Process Perspective: Evaluates the efficiency and effectiveness of internal processes, such as risk management, operational efficiency, and compliance.

- Learning and Growth Perspective: Assesses the bank's ability to learn, innovate, and adapt, focusing on employee skills, training, and knowledge management.

Embracing the Future: The Path Forward with BRBS

The Banking Risk Balanced Scorecard represents a significant advancement in risk management and strategic planning for banks. By embracing this holistic framework, financial institutions can enhance their value, manage risks effectively, and achieve sustainable success. As the financial landscape continues to evolve, the BRBS will remain an essential tool for those seeking to thrive in a competitive market. The future of banking is undoubtedly intertwined with the strategic insights and comprehensive approach offered by the Banking Risk Balanced Scorecard.